-

Startup India

- Startup India Standup India

- What is Startup India portal

- Overview of the Indian Startup Ecosystem

- Here are some problems india facing (Ideas for New Startup)

- Expand Business in India

-

Registration

- Business Registration

- Introduction

- Company Registration

- Proprietorship Registration

- Partnership Registration

- Limited Liability Partnership

- One Person Company Registration

- Private Limited Company Registration

- Public Limited Company Registration

- Special Entity Registration

- Section-8 Company Registration

- Trust Registration

- Society Registration

- Industry Specific Registration

- Fssai Registration

- Import Export Code Registration

- Tax Registration

- GST Registration

- PF ESI Registration

- Intellectual Property Rights

- Trademark Registration

- Copyright

- Certification

- ISO Certification

- Things to do After Incorporation

- Stage-1 : Basic Necessity

- Stage-2: Industry Specific Necessity

- Stage-3: Go Live & Get Funding

-

Compliance

- Startup Compliances

- Introduction

- Company Law Compliances

- ROC Annual Compliances

- ROC Event Compliances

- Tax Compliances

- GST Compliances

- Income Tax Filing

- BookKeeping & Accounting

- PF ESI Compliances

-

Go Online

- Development of Aura of Your Business

- Website Development

- Mobile Application Development

- CRM Development

- Content Writing

- Blog Writing

- Video Production

- Plugins and APIs

- Retargeting & Remarketing

-

Tutorials

- Startup Related Tutorials

- Tax Benefit for Startups

- Get Fund from Angel Investors

- Get Fund from Venture Capitalists

- How to Startup Recognize

- Start India Eco-system

- Pradhan Mantri Mudra Yojna

- Credit Guarantee for MSME

- GeM Portal

- What Govt doing For Startups

- Thing Keep in Minds Before Startup

- One Reason Behind Startup Failure

- How to Increase Team Productivity

- Aatmanirbhar Bharat

- Women Entrepreneurship Platform

- Legal Drafting

- PSB loans in 59 minutes

- 10 Strategy for Startup Success

- Business Registration Tutorials

- Proprietorship Registration

- Partnership Registration

- Limited Liabilty Partnership

- OPC Registration

- Private Limited Company Registration

- Public Limited Company Registration

- Nidhi Company Registration

- Section-8 Company Registration

- Non-Profit Organization

- Trademark Registration

- ESI/PF Registration

- FSSAI Registration

- Import Export Code Registration

- ISO Certification

- Naming Guidelines

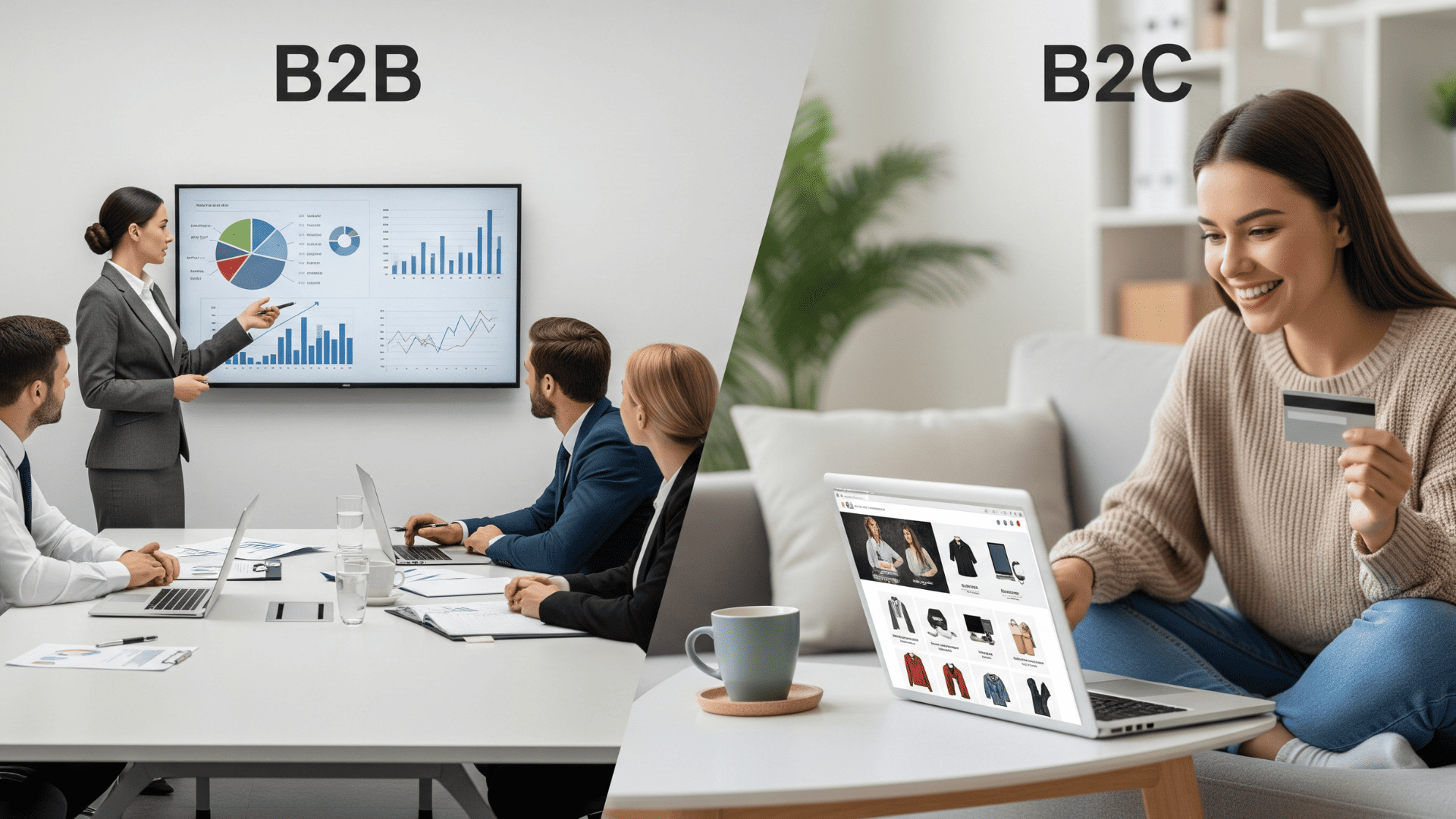

- Type of Business Registration

- NITI AAYOG Registration

- Compliance Tutorials

- Change Company Registered Address

- ROC Annual Compliances

- GST Registration & Compliances

- Startup Compliances

- LLP Compliances

- Income Tax in India

- Share Capital

- How to Change Company Name

- Change in Company Objective

- Cost of Non Compliances

- Is Business Accounting is important

- TDS and ITS Returns

- Benefits of filing ITR

- Tax Audit

- Income Tax Return Filing

- Notices Issued Under the Income Tax

- Income Tax Slabs

- Digital Marketing Tutorials

- How to Develop CRM

- How to Generate Leads

- How to Write Blog

- How to Develop Mobile App

- How to Develop Website

- How to Create Videos

- Online Business

- How to Create Content

- Ecommerce Website

- Landing Pages

- Video Marketing

- Facebook for Business

- Startup Marketing Strategies

- Build Online Presence

- Adwords

- Lead Generation

- Digital Marketing

- Downloads

- Packages

- Login/Sign Up

India’s 1st Startup Consulting Company Earns YouTube Silver Button

10 crores and the capitalization (product of the issue price and the post issue number of equity shares) of the applicant's equity shall not be less than

10 crores and the capitalization (product of the issue price and the post issue number of equity shares) of the applicant's equity shall not be less than