Introducing the main Union Budget of the third decade of the 21st century, Finance Minister Smt. Nirmala Sitharaman, today revealed a movement of broad changes, planned for empowering the Indian economy through a combination of short-term, medium-term, and long-term measures.

The Aims of Union Budget as per FM:

- To accomplish consistent conveyance of services through Digital administration

- To improve physical personal satisfaction through National Infrastructure Pipeline

- Risk moderation through Disaster Resilience.

The budget is woven around three unmistakable subjects:

- Aspirational India in which all areas of the general public look for better ways of life, with access to wellbeing, instruction, and better employments.

- Economic development for all showed in the Prime Minister's appeal of "SabkaSaath, SabkaVikas, SabkaVishwas".

- Caring Society that is both conscious and humane, where Antyodaya is an article of faith.

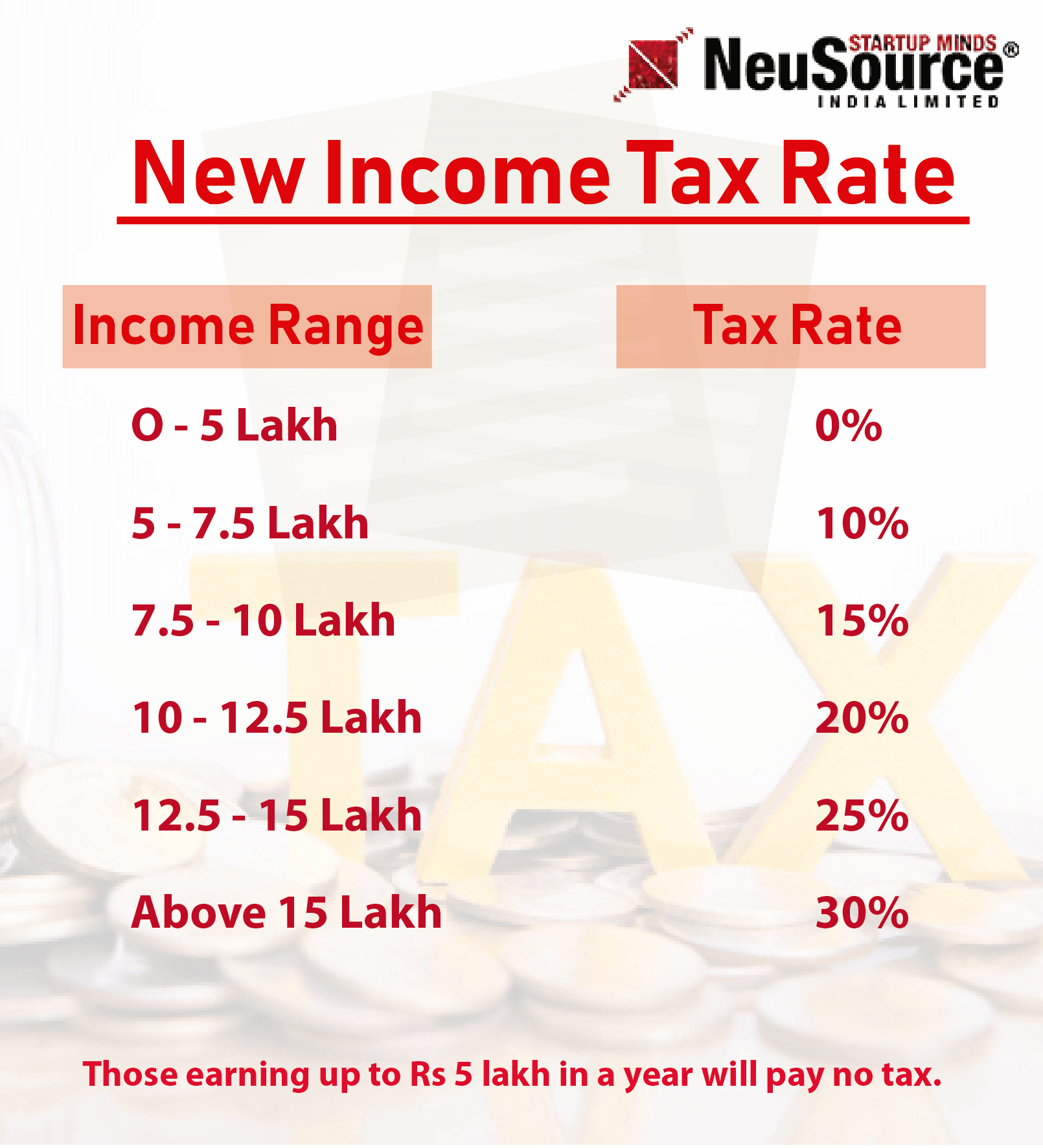

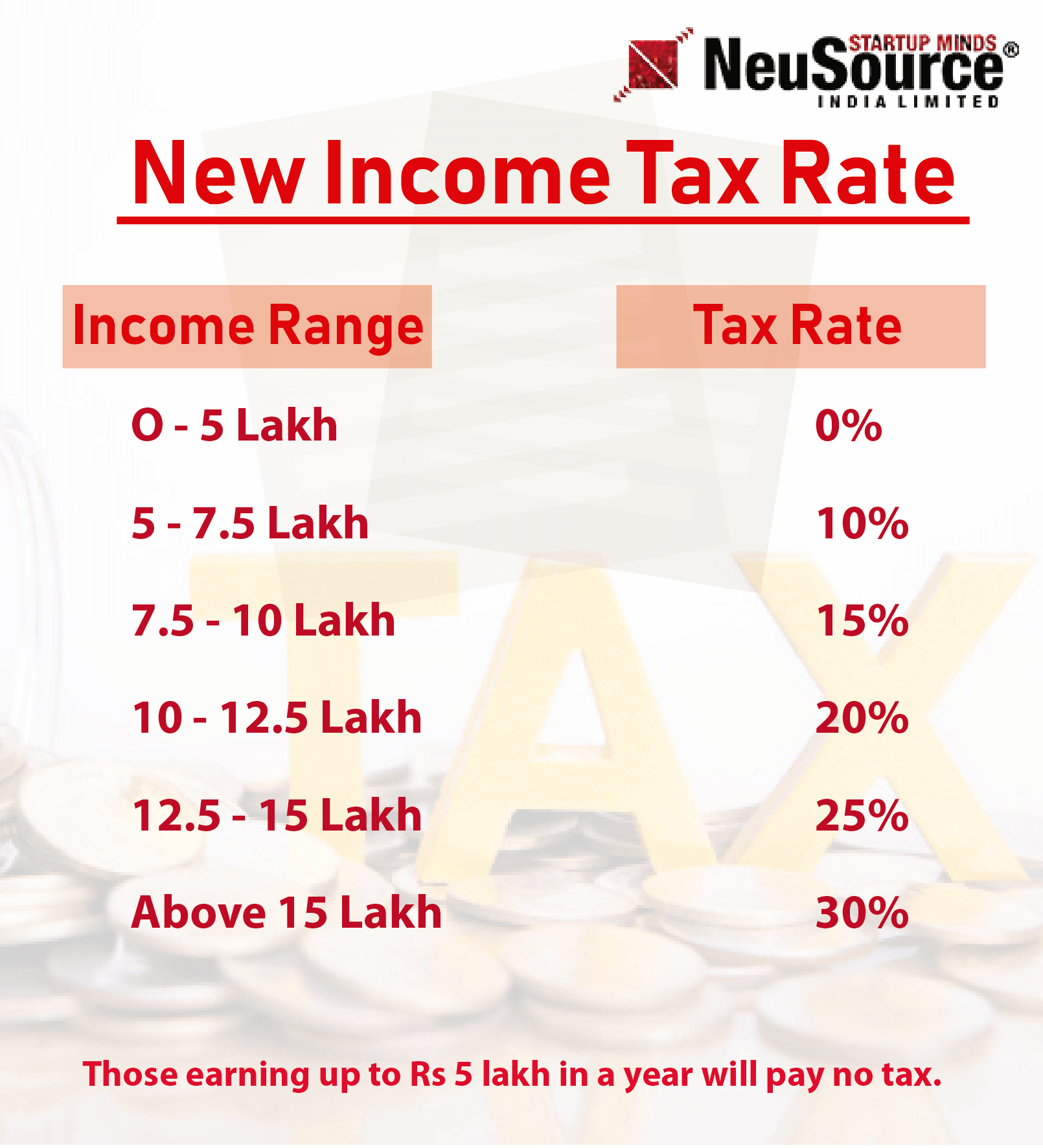

NEW INCOME TAX SLAB RATES - NO EXEMPTIONS APPLICABLE

- 0% for income up to 5 lacks

- 10% for income between Rs 5 lakh-7.5 lakh

- 15% for income between Rs 7.5 lakh-10 lakh

- 20% for income between Rs 10-12.5 lakh

- 25% for income between Rs 12.5 -15 lakh

- 30% for income above Rs 15 lakh

This means a lower tax rate for those in the Rs 5 to 15 lakh section. No tax up to Rs. 5 Lacks

- The new tax system shall be optional for taxpayers. A person who is currently availing more deductions and exemptions under the Income Tax Act may decide to profit them and keep on paying expenses in the old system.

Instant PAN through Aadhaar

- In order to further ease the procedure of allotment of PAN, a framework will be launched under which PAN will be right away distributed online based on Aadhaar, with no necessity for filling up of detailed application form.

The government has introduced a new scheme named “Vivad se Vishwas” scheme:

- A taxpayer would be required to pay just the measure of the disputed taxes and will get a complete waiver of interest and penalty, if he pays by 31st March 2020. The individuals, who will benefit from the plan after 31st March 2020 should pay some extra sum. The plan will stay open till 30th June 2020.

GST

- A simplified GST return will be executed from the 1st April, 2020. It will make return filing basic with features like SMS based filing for nil return, return pre-filling, improved input tax credit flow and general simplification. Dynamic QR-code is proposed for purchaser invoices. GST parameters will be caught when payment for purchases is made through the QR-code.

On Financial Markets, about strengthening of the bond market, certain specified categories of Government securities would be opened fully for non-resident investors, apart from being at one's fingertips for domestic investors as well.

Smt. Sitharaman said that a policy to empower the private sector to build Data Centre parks throughout the country will be brought out soon. Fiber to the Home (FTTH) connections through Bharatnet will joint 100,000-gram panchayats this year. It is offered to provide 6000 crores to Bharatnet program in 2020-21.

- The government now initiates to sell a part of its equities in LIC with the help of an Initial Public Offer (IPO).

- To boost the investment by Sovereign Wealth Fund of foreign governments, the Finance Minister has come up with the idea to grant 100% tax exemption to their interest, dividend and capital gain income in respect of the investment made in infrastructure and other notified sectors before 31st March 2024 and with a minimum lock-in period of 3 years.

- Cooperative societies are currently taxed at a rate of 30% with surcharge and cess. As a major concession, and in order to bring uniformity between the cooperative societies and corporates, the Finance Minister has suggested providing an option to cooperative societies to be taxed at 22% plus 10% surcharge and 4% cess with no exemptions/deductions.

- The income of Charity Institutions is fully exempt. Donation made to these institutions is also entitled as a deduction in assessing the taxable income of the donor. It is suggested to pre-fill the donee’s information in the taxpayer’s return on the basis of information of donations made by the donee.

- To claim the tax exemption, charity institutions need to be registered with the Income Tax Department. It is proposed to make the registration completely electronic under a unique registration number (URN) to be issued to all new and existing charity institutions.

- Estimated revenue for 2020-21 is at Rs. 22.46 lakh crore and expenditure is at Rs. 30.42 lakh crore.

- The finance minister proposes a 100% profit deduction for 3 years out of 10 years for startups having turnover up to 100 crores.

- Finance minister Sitharaman raises excise duty by way of national calamity unexpected duty on cigarettes, tobacco products.

- Proposes to cut import duty on newsprint to 5%

FM has additionally proposed to exempt these social orders from Alternative Minimum Tax (AMT), simply like companies under the new tax regime are exempted from the Minimum Alternate Tax (MAT).

Reforms accomplished in PSBs :

- 10 banks consolidated into 4.

- Rs. 3,50,000 crore capital infused.

E-commerce operators will now have to deduct TDS on all payments to web based business participants at 1 percent with those having PAN/Aadhaar and 5 percent for those without non-PAN/Aadhaar

The dividend shall now be taxable in the hand of the recipient.

Finance Minister Nirmala Sitharaman said 100 additional air terminals will be developed by 2025 to help the UDAN scheme. Other important declarations are:

-

- Rs 1.7 lakh crore has been provided for transport infrastructure in 2020-21

- 150 trains will run under the public-private partnership (PPP) mode

- Four stations will be redeveloped with the help of the private division

- More Tejas type trains to associate tourist destinations

- Under consideration is a proposal for setting up huge solar power capacity alongside railway tracks

Around 70 of more than 100 income tax deductions and exemptions have been removed, in order to improve tax system and lower tax rates

Dividend distribution tax (DDT) shifted to individuals instead of firms

Budget 2020 has shifted dividend distribution tax to individuals rather than companies. Different measures include:

- Concessional tax rate of 15 % has been spread out to power generation companies

- 100 per cent tax concession planned to sovereign wealth funds on investment in infra projects

- Concessional retaining rate of 5 percent on interest payment to non-residents has been extended up to June 30, 2022

- Another proposal is the deferment of tax payment by employees on the employee stock ownership plans (ESOPs) from startups by five years.

The NeuSource Startup Minds official the best Business Startup Consultant gives Startup Consulting Services in India helps you to become a successful entrepreneur and generates good leads for your business.

Shruti

“An idea can change your life”: Well it’s true! I am glad that India is rising its way towards startup culture. It has literally pushed people to at least give it a try and not just live in a bubble. Being an entrepreneur you need a team and Neusource is there to help you and to raise your startup.